Οι τιμές του πετρελαίου υποχώρησαν αρχικά κατά 1% και πλέον κατά την έναρξη των συναλλαγών στην Ασία, προτού ανακτήσουν μέρος των απωλειών τους, τη μεθεπομένη της απαγωγής του Προέδρου της Βενεζουέλας Νικολάς Μαδούρο κατά τη διάρκεια στρατιωτικής επιχείρησης των ΗΠΑ, εξέλιξη που ακολουθήθηκε από την ανακοίνωση της Ουάσιγκτον πως εννοεί να εκμεταλλευτεί εκείνη τα μεγάλα αποθέματα αργού της χώρας της Λατινικής Αμερικής.

Περί τις 08:00 (ώρα Ιαπωνίας· 01:00 ώρα Κύπρου), η τιμή της αμερικανικής ποικιλίας αργού WTI υποχωρούσε στα 56,6 δολάρια το βαρέλι, ενώ αυτή του Brent Βόρειας Θάλασσας στα 60. Κατά τις 08:20 (01:20), το WTI υποχωρούσε κατά 0,60% στα 56,98 δολάρια το βαρέλι και το Brent κατά 0,49% στα 60,45.

Μετά τους αεροπορικούς βομβαρδισμούς και την αιχμαλώτιση από τις αμερικανικές ένοπλες δυνάμεις του Νικολάς Μαδούρο και της πρώτης κυρίας Σίλιας Φλόρες, ο Πρόεδρος των ΗΠΑ Τραμπ είπε πως θα δώσει άδεια σε αμερικανικές πετρελαϊκές εταιρείες να εκμεταλλευτούν τους πόρους της Βενεζουέλας.

Πρόσθεσε πως η Ουάσιγκτον θα «κυβερνά» τη χώρα ωσότου υπάρξει «ασφαλής, προσήκουσα και δίκαιη μετάβαση».

Η Βενεζουέλα διαθέτει ορισμένα από τα μεγαλύτερα αποθέματα αργού στον κόσμο, πάνω από 303 εκατομμύρια βαρέλια (17-20% του συνόλου), κατά τον ΟΠΕΚ, του οποίου είναι μέλος—μεγαλύτερα από αυτά της Σαουδικής Αραβίας (267 εκατ.) και του Ιράν.

Όμως η παραγωγή ήταν ιδιαίτερα χαμηλή πριν από την αμερικανική επέμβαση, στο 1 εκατ. βαρέλια/ημέρα, έναντι 3,5 εκατ. όταν αναλάμβανε την εξουσία ο Ούγο Τσάβες, προκάτοχος και μέντορας του Νικολάς Μαδούρο, το 1999.

Καθώς η παγκόσμια αγορά θεωρείται ήδη επαρκώς εφοδιασμένη, οι πιθανές αναταράξεις όσον αφορά την παραγωγή της Βενεζουέλας (1% της παγκόσμιας προσφοράς) αναμένεται να είναι περιορισμένες, σύμφωνα με αναλυτές.

ΚΥΠΕ

Oil Prices React to US Action in Venezuela

Following the US operation in Venezuela and the capture of President Nicolás Maduro, oil prices initially fell but then partially recovered. The American WTI crude grade fell by 0.60% to $56.98 a barrel, while North Sea Brent fell by 0.49% to $60.45. President Trump announced that the US would allow American oil companies to exploit Venezuela's vast oil reserves, with the aim of 'governing' the country until a 'safe, proper and fair transition' is achieved. Venezuela holds the largest oil reserves in the world, surpassing even Saudi Arabia and Iran, however its production has decreased significantly in recent years, from 3.5 million barrels per day to 1 million. This decline is due to various factors, including political instability and economic difficulties. However, analysts estimate that potential disruptions to the global oil market will be limited, as Venezuela accounts for only 1% of global supply. The market is already considered adequately supplied, so an increase in Venezuelan production, even if it occurs, is not expected to have a significant impact on prices. This development is being closely monitored by international markets, as access to Venezuela's reserves could change the balance of global energy policy. However, political uncertainty and potential difficulties in exploiting these reserves remain important factors to consider.

You Might Also Like

Ο Μαδούρο θα δικαστεί σε δικαστήριο στη Νέα Υόρκη

Jan 3

Live το διάγγελμα του Τραμπ για σύλληψη Μαδούρο: «Θα διοικήσουμε τη Βενεζουέλα, ο δικτάτορας θα λογοδοτήσει»

Jan 3

Χρονικό της επίθεσης των ΗΠΑ κατά της Βενεζουέλας και της απαγωγής Μαδούρο

Jan 3

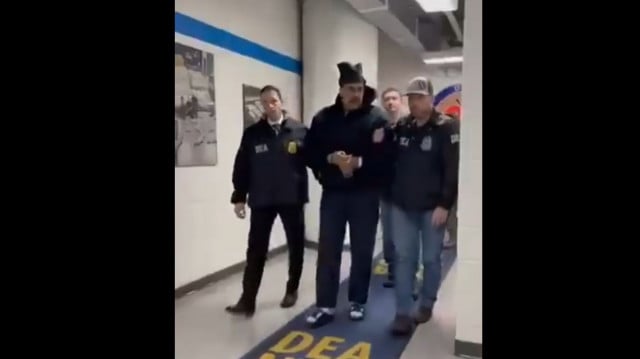

Ο Νικολά Μαδούρο οδηγείται δεμένος στις ΗΠΑ, για πολιτική μετάβαση λένε οι ΗΠΑ

Jan 4

«Καληνύχτα και καλή χρονιά»: Τα πρώτα λόγια Μαδούρο με χειροπέδες στα γραφεία της DEA στο Μανχάταν (ΒΙΝΤΕΟ)

Jan 4